Content

When starting a bookkeeping business, you need to work out the number of hours you can work. Deduct time for completing your accounts, retail accounting meetings for potential clients and research time. Accountants can also offer good tax advice and help with any questions you may have.

Is a bookkeeping business profitable?

Starting your own bookkeeping business can be pretty profitable. There aren't significant barriers to entry if you already have experience. Aside from technical skills, you just need a computer, internet connection, and place to work.

This course is designed for people who are already qualified to Level 3with the ICB who wish to gain an understanding of principles and practice of starting their own Bookkeeping Business. This course is designed for study by distance learning at work or at home. Students will receive course materials, assignments plus tutor support by email and telephone. You can start at any time and plan your studies over a period of up to one year from the time of registration.

What qualifications do I need?

This entirely online course has expanded on some ways you can work to resolve bookkeeping of many sorts as it suits your need. Bookkeeping has been enriched with a further demonstration of saving money, growing a business, and running a successful company to ensure you can do your job as a Bookkeeping expert. Generally, a bookkeeping business has a low startup cost, especially when you decide to run your business virtually; you will only pay roughly $2,000 to $3,000 to get started if you already have a laptop. Complete the Bookkeeping Business Pathway to set up and launch your bookkeeping career with the option to freelance, subcontract or create your own bookkeeping business.

You can register as a sole trader or as a limited company. You will need to register your business name and any other relevant information. All your personal and business passwords should be set https://www.globalvillagespace.com/GVS-US/main-features-of-bookkeeping-and-accounting-in-the-real-estate-industry/ up with two-factor authentication. This means you will need to prove your identity in two ways, such as with your usual password and with a code that is sent to your registered mobile number.

Starting a bookkeeping business – Learning some basic selling skills

Oxbridge offers an ICB Level 2 Certificate in Bookkeeping. If the Level 2 seems too much at this point, we also offer an Introduction to Bookkeeping course. Being an ICB member means you will receive supervision through the Practice Licence scheme that all self-employed bookkeepers need to have in place to be able to operate. The area of bookkeeping can be very versatile, especially if you are interested in starting your own business. Businesses of every size and structure require resources to help manage their finances.

Spyware can monitor and collect your personal information and any information stored on your computer or electronic devices without you realising it. Some types of spyware can even detect your passwords and gain access to financial information. Ensure all your devices have anti-spyware software to protect your business and your clients.

Switch your browser for the best experience on Reed Courses

Mostly bookkeeper go with LLC, but if you are just starting out and have limited funds, you can consider a Sole Proprietorship. The business structure you select determines your tax liabilities and the personal liabilities if your business ever gets sued. You will have to go with a business structure whenever you decide to start your own business. While you may not require a fund, you can consider other crucial aspects of a business, like ways of marketing, projection of income and expenses, targeted industry and so on. On the other hand, a large business with a rented office can carry the startup cost of closer to $50,000 $100,000.

- It’s very important to find out whether there will be enough demand for your bookkeeping services business.

- From employment law to product safety, businesses must comply with a wide range of rules.

- Branding could include creating your business’s visual identity, a logo, your business name, and creating your business website.

- For increased marketability, you can become a specialist in one accounting application.

You can find a range of CPD courses on Reed Courses, many of which can be completed online. You can start with any skill set and will reach the next level at the end of this course. Alison combines her role at Silicon Bullet with her Forever Living network marketing businesses and is often to be seen at business networking meetings as she likes to keep busy. The first time I said no to a client who wanted me to be their bookkeeper was a really hard decision, but was exactly the right thing to do at the time.

Online Delivery

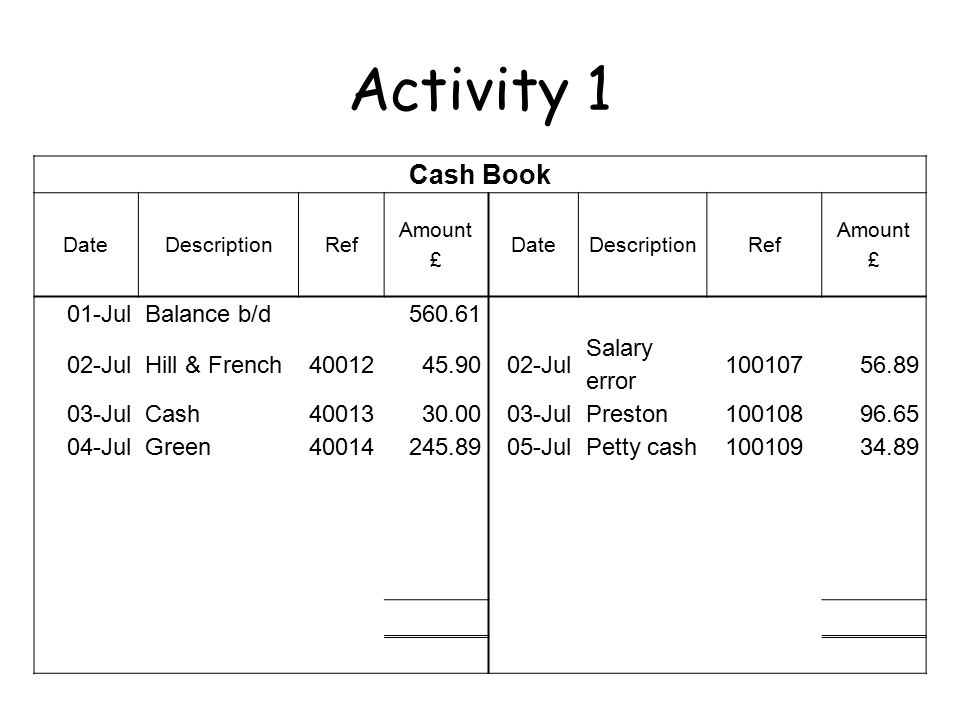

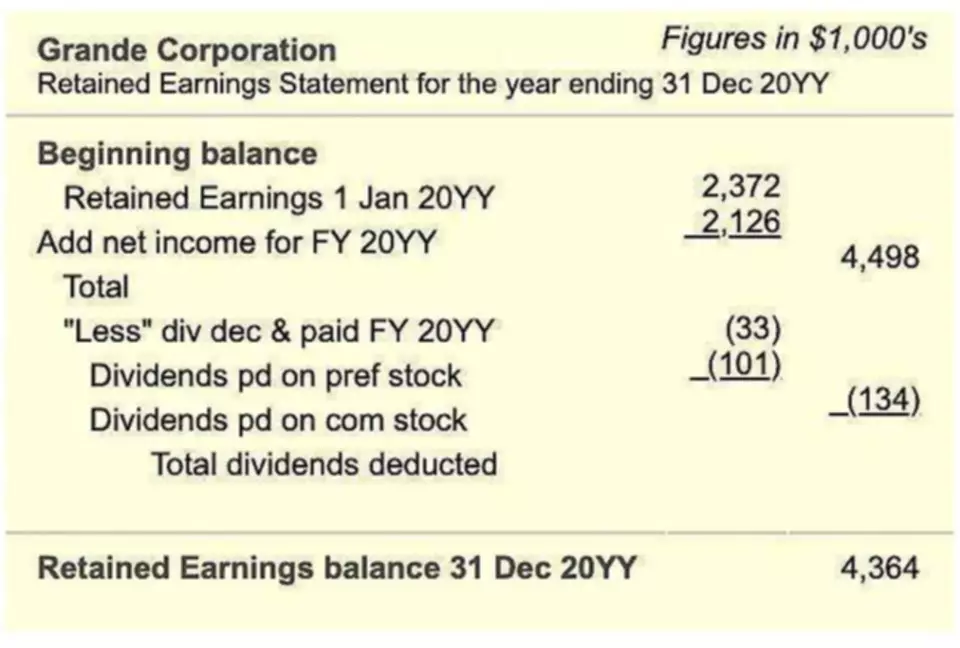

This knowledge will help you determine current rates of pay and the range of services offered. Carrying out research into other services will also enable you to determine if there are any gaps in the market that could allow you to set yourself apart. The data from these books or ledgers creates the foundation for the annual accounts for tax and company https://www.world-today-news.com/accountants-tips-for-effective-cash-flow-management-in-the-construction-industry/ accounting purposes. The statements produced include a Profit and Loss Account a Balance Sheet and cash flow forecast. The tax and other non-cash related items such as depreciation get calculated when the accounts are drawn up. These are the bookkeeping basics every business owner must produce each year for tax purposes and to satisfy HMRC.

- With the right software and apps it’s easy to work with people wherever you are in the world.

- Accountancy Learning Ltd specialises in the provision for accountancy training.

- In fact, sole trader accounts don’t even need to be signed off by a qualified accountant for tax purposes.

- The Financial Reporting Standards ensure that companies maintain their credibility and report their finances in an honest and transparent manner.

- She has been helping clients to be better bookkeepers in Sage 50 for over 24 years and has been Xero Accredited in accounts and payroll for a number of years too.

- Accounts Portal can help you get set up and ready to work with clients quickly and cost-effectively.

Determining your typical customer base can help you to plan your advertising and marketing strategies and help you to make your business most attractive to prospective customers. The types and sizes of the businesses you target will also help you to calculate your pricing. Each client you take on will be long term and even clients who hire you for a one-time bookkeeping job will likely require your services for weeks or months. The longer sales process involved in bookkeeping will mean you won’t have the capacity to take on more clients and it will take longer for you to earn each commission. Bookkeepers are needed all over the world and many other countries place value on bookkeepers who have knowledge of the UK and US financial markets. You could move abroad and run your business from another country or even move your business to another part of the UK.

From employment law to product safety, businesses must comply with a wide range of rules. Give yourself confidence in your abilities by being your best client. Once you’ve identified your ideal client, then you can put specific solutions together for them.

- Having skills in bookkeeping is extremely important in many industries and positions.

- Anti-virus software should be installed on all of your devices and your home/office Wi-Fi.

- You are aiming at a local market, so give them a local landline.

- So promote your services through the many online business forums and offer impartial advice to get recognised.