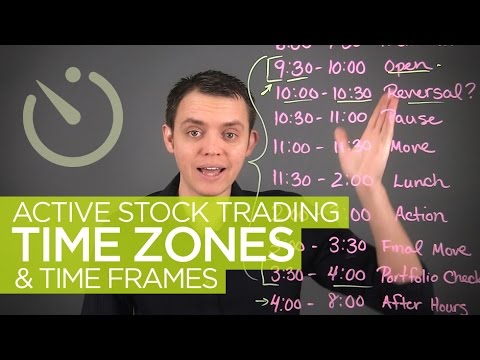

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. TradeGATEHub provides a charting session where traders can see market fluctuation by symbols.

Online trading brings a broader introducing broker definition. Today, it can also be a broker partner or affiliate as well as a signal provider (copy master) in the copy trading ecosystem. A broker-dealer who had a direct relationship with a client, but delegates the work of the floor operation and trade execution to another firm. Introducing Brokers are able to charge a fee-per-trade unit for each asset class, markup (or markdown) interest rates, or manually invoice the client for services rendered.

This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice. The IB is usually affiliated with the FCM, either as an independent entity that is partnered with that merchant firm or as a direct subsidiary of that FCM. An introducing broker (IB) is an individual or an investment company that introduces a client to Forex trading, futures, or options trading. IBs or introducing agents do not receive assets or money from the clients.

Your goal is to portray yourself as a reliable and trustworthy voice with valuable insights into the world of online forex trading. Think in terms of podcasts and YouTube videos, trader eBooks, a regular financial column, blog posts and guest posts. Get people liking, commenting and quoting you on social media. If you can build a genuine following on Facebook, Instagram and Twitter, you’re already one step ahead.

How Introducing Brokers make money and how much they can earn

FCMs supply trading platforms on which clients have the ability to place trades online and are responsible for account management. However, the majority of FCMs would find it financially impossible to open offices around the country to serve their customers. This is where IBs excel since they typically operate out of smaller offices located all over the country. An introducing broker (IB) acts as a middleman by matching an entity seeking access to markets with a counterparty willing to take the other side of the transaction. Generally speaking, IBs make recommendations while delegating the task of executing trades to someone who operates on a trading floor. The introducing broker and whoever executes a transaction split the fees and commissions according to some agreed upon arrangement.

IBs do not undertake trades themselves; they delegate the client transaction to someone on the trading floor. Unlike affiliate marketing, Introducing Broker programs give you the chance to hand your clients a customized experience in terms of the service the brokerage offers. This type of freedom allows you to improve your offering to attract more clients. You don’t need to depend solely on the brokerage, if you can give something more you will be more successful . Providing something clients value, by doing so – as mentioned beforehand – you can attract high-value customers that can give you a boost in your commission. With more people spending time online and looking for ways to stretch their savings, now is the best time to build a client base for a partner brokerage.

- The introducing broker and whoever executes a transaction split the fees and commissions according to some agreed upon arrangement.

- If clients feel that you are well-informed, they will respect your judgment and have faith in your advice.

- Under an IB Program, the IB will partner with a regulated Broker.

It also has an active discussion environment, multiple forums, trading rooms, and a watchlist market with Majors, Commodities, Crypto, and Indices information. There are other platforms that traders use to share information. Reddit for example, has multiple investing and trading communities to choose from. You work on setting yourself apart from competitors, and you build – preferably long-lasting – business relationships. If you have ever talked to someone who has given entrepreneurship a real shot, they’ll tell you how they grew as a person, regardless of the level of success they achieved. By deciding to become an Introducing Broker, you are essentially establishing your own business.

The agreement is required by IIROC under IIROC Rule 2400, Introducing/Carrying Broker Arrangements. IIROC must approve of the arrangement before it becomes effective. The clearing firm, not the introducing broker, receives payments and securities from the clients and handles record-keeping. The introducing broker, who earns a commission on the transaction, typically pays a fee for each trade and interest on margin loans the clearing firms make to the clients it introduces. A broker-dealer (B-D) is a person or firm in the business of buying and selling securities for its own account or on behalf of its customers.

Find the Right Brokerage to Partner with

If the world of investing fascinates you, and if you want to make money without executing direct trades, you may find success as an introducing broker (IB). Like an affiliate marketer, an introducing broker partners with an actual brokerage, but its role is distinct from an affiliate. They offer more services and can also make higher commissions. We are one of the only brokers in the world to offer these four FX trading platforms; MT4, MT5, cTrader, and Currenex. Once you provide your potential clients with your custom IB application link they will have the choice to choose between one of these four amazing FX trading platforms.

These include providing investment advice to customers, supplying liquidity through market-making activities, facilitating trading activities, publishing investment research, and raising capital for companies. Broker-dealers range in size from small independent boutiques to large subsidiaries of giant commercial and investment banks. An Introducing Broker (IB) is a person or company who acts as an intermediary between the broker and the client. The IB, drives business to the brokerage firm while also providing additional customer support to both the client and the dealer. Another strategy for Introducing Brokers to make money is to get many “small fish” – rookie traders.

What Is An Introducing Broker (IB)?

FCMs accept orders to buy or sell futures contracts, options, or forex swaps. If you want to earn high commissions as a successful introducing broker, you need to develop an online presence. Not only do you need to reach new clients, but your name needs to be ‘Google Gold’. Put simply, if a potential client Googles your name, they need to see a list of positive and powerful returns that immediately portray you as a credible financial commentator. What you’re basically doing is creating a personal brand and marketing yourself. If you can think strategically and work systematically, you can develop a high-value online presence.

- But if you’re looking for more benefits and possibilities, making a career out of being an Introducing Broker is a great opportunity.

- Here we actually see a new marketing model with a chance for IBs to create a multi-level network of customers that generate revenues not only for the introducing broker but also for themselves.

- He or she has a direct relationship with the client but leaves the trade execution to the broker they partner with.

- Once you provide your potential clients with your custom IB application link they will have the choice to choose between one of these four amazing FX trading platforms.

- The Broker will then provide a trading platform(s) for the IB’s clients to trade.

Initially, an introducing broker is an intermediary between a client who wants to sell different assets and the financial market. IBs can either act as recommendation providers or execute trades directly on the customers’ behalf. Generally, the term mainly referred to land-based service providers. However, with the evolution of technologies and brokerage platforms.

It’s a flexible job where you can develop your skills and manage your own time while making money. An Introducing Broker (IB) is an individual or organization that refers new clients to a trading company (a broker) and receives compensation for those referrals. In order to earn money, IBs must get clients, within time, as your client base grows you now have the chance to travel the world in search of new opportunities, or stay local and develop your business at home.

They are more likely to want to do business with you than directly with the broker. These variables that determine the additional value for clients can be a way to get high-value clients that can get you $1,000 in commission every week. Any information posted by employees of IBKR or an affiliated company is based upon information that is believed to be reliable. However, neither IBKR nor its affiliates warrant its completeness, accuracy or adequacy.

Trading is great, you can learn a lot and if you’re good you can make some money. But if you’re looking for more benefits and possibilities, making a career out of being an Introducing Broker is a great opportunity. It will take hard work as you are going down the road of becoming an entrepreneur, but if you’re passionate, hardworking, and have a way with people, Tradeview’s IB program has many benefits for you. Just as important, take your clients’ needs into account in all of your marketing but particularly when making a website. However, it is ALSO important to mention that anyone can become an experienced trader, like everything else in life it just takes time.

Also, the best brokerages have marketing assistance to affiliates and IBs with banners, landing pages, and embeddable materials for websites. This agreement is between an introducing broker and a carrying broker for the purposes of establishing a Type (1-4) introducing/carrying broker arrangement. A Type (1-4) introducing/carrying broker define introducing broker arrangement is one of four introducing carrying broker arrangements where an introducing broker is allowed to introduce clients to a carrying broker. In this agreement, the Type (1-4) carrying broker has agreed to perform certain services including clearing and record-keeping activities for the Type (1-4) introducing broker.

We go above and beyond to offer clients the ultimate trading experience. As with any other business, marketing plays an essential role in getting new clients and beating previous sales numbers. Whether you are marketing on social media, search engines, or traditional marketing techniques, developing a plan for getting new clients will play a large role later on as you start to expand. You should always consider marketing yourself first as a person and expert in the field, build your personal brand, become a well-known voice in the industry, and clients will come to you. One of the things many people don’t take into consideration when choosing a broker is the diversity of the trading platforms offered. As you get more and more clients you will find traders that have preferences for one platform or another.

IBKR LLC (U.S.)

They may also acquire a piece of the securities offering for their own accounts and may be required to do so if they are unable to sell all of the securities. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

An Introducing Broker (IB) is an individual or organization that refers new clients to a trading company (a broker) and receives compensation for that referral. Now, let’s have a look and different types of introducing brokers. Alternatively, an IB will need additional financial resources if it tries to work without an FCM. In addition, an IB would have to spend a substantial amount on overhead—for accounting, trading, reporting, and trading platforms. A brokerage acts as a broker (or agent) when it executes orders on behalf of its clients, whereas it acts as a dealer, or principal when it trades for its own account. Social Media is most effective when kept current and consistent.

Introducing brokers help increase efficiency and lower the work load for futures commission merchants. The arrangement allows for specialization where the IB focuses on the client while the FCM focuses on trading floor operations. IBs are middlemen, a link between the client and the trading floor. Finally, IBs acquaint clients with the current market conditions and the critical aspects of financial markets. As a result, IBs are better connected to clients; they maintain long-term relationships. Broker-dealers fulfill several important functions in the financial industry.

The MCU Is Going Through a Breakup Phase – The Escapist

The MCU Is Going Through a Breakup Phase.

Posted: Fri, 12 May 2023 15:00:42 GMT [source]

They do not just bring new customers to the trading platform but also provide individual advisory and other resources to establish a long-term relationship with customers that bring benefits for both. Here we actually see a new marketing model with a chance for IBs to create a multi-level network of customers that generate revenues not only for the introducing broker but also for themselves. By definition, broker-dealers are buyers and sellers of securities, and they are also distributors of other investment products. As the name implies, they perform a dual role in carrying out their responsibilities. As dealers, they act on behalf of the brokerage firm, initiating transactions for the firm’s own account. As brokers, they handle transactions, buying and selling securities on behalf of their clients.

CFTC Staff Advisory Expands List of Entities that May Need to … – Lexology

CFTC Staff Advisory Expands List of Entities that May Need to ….

Posted: Fri, 03 Dec 2021 08:00:00 GMT [source]

Many IBs are one-person operations, while others are larger, multi-location businesses. IBs are better able to service their clients as they are local, and their primary goal is customer service. Outsourcing the prospecting and servicing of clients to the IBs creates economies of scale for FCMs and the futures industry. As an Introducing Broker, you can make progress toward your goals within the business every day. You will get involved in a dynamic program, where the more clients you refer, the greater your income potential will be.

They should give you the option to negotiate a personalised commission plan for introducing brokers. Read and stay up to date on the financial news daily and where stocks, commodities, currencies, and other vehicles are heading. If clients feel that you are well-informed, they will respect your judgment and have faith in your advice.

Just because anyone CAN become an IB, doesn’t mean anyone SHOULD become an IB. Keep in mind that in a way, people will be depending on you; on the information you provide, as well as the support you give. Any information provided by third parties has been obtained from sources believed to be reliable and accurate; however, IBKR does not warrant its accuracy and assumes no responsibility for any errors or omissions.

Try to post on all social media platforms on a regular basis. This gives followers consistent and relevant information that will continually keep your business in their minds, turning followers into clients. Under an IB Program, the IB will partner with a regulated Broker. The Broker will then provide https://trading-market.org/ a trading platform(s) for the IB’s clients to trade. In a certain way, as an IB you are taking a step into the world of entrepreneurship. If you have ever talked to someone who has given entrepreneurship a real shot, they’ll tell you how they grew, regardless of the level of success they achieved.

.jpeg)